we grew within charity

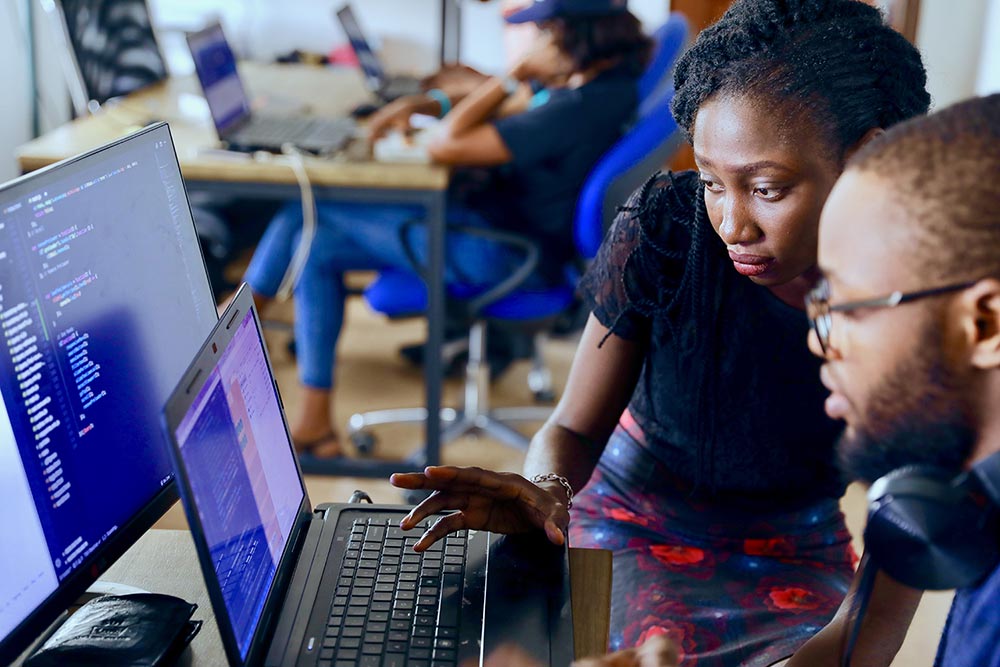

Our story

Charity Accounting Services was founded with the mission to make life easier for charities. Since we founded in 2009, we have provided charities accounting services and back-office administration.

We are an accounting firm dedicating services to charities and non-profit organisations

We are an accounting firm dedicating services to charities and non-profit organisations

Charity Accounting Services was founded with the mission to make life easier for charities. Since we founded in 2009, we have provided charities accounting services and back-office administration.

Charity Accounting Services was founded almost 20 years ago, by our Finance Director, Golam Morshed. Morshed started his career as a frontline finance staff for numerous charities before establishing his own charity-specialised accounting firm.

Charity Accounting Services was set up to consult charities on strategic financial management. Our vast experience in the charity sector has made our team well-equipped to assist your organisation.

Charity Accounting Services was set up to consult charities on strategic financial management.

At Charity Accounting Services, we believe that client communication should be at the heart of account outsourcing.

You Can Expect:

By outsourcing to Charity Accounting Service, we promise your organisation:

Save valuable hours to advance your cause while we handle the numbers.

Tap into instant advice from specialists to ensure financial clarity every step of the way.

Enjoy cost-effective strategies tailored to your charity's needs.

Our full accounting services include bookkeeping, payroll, management accounts, donors’ reports, attending meetings, and producing annual accounts and trustees reports of the Charity Commission.

Ultimately, you decide what services your organisation requires. If your needs change over time, we will adapt our strategy to accommodate your new needs.

Benefits of Outsourcing Include:

When you submit an enquiry, we’ll go through the following onboarding steps:

We use the latest softwares like QuickBooks, XERO, SAGE and others. You do not need to invest in buying and purchasing software as well as relevant hardware.

In situations where you already have in-house accounting staff, we will simply fill in the gaps and provide services or advice in areas where in-house skills and availability of staff are not adequate. In a few situations, we act as a sounding board for the chief executive.

We help charities of all sizes.

From our experience, smaller charities struggle to get effective and relevant accounting services. For these charities, investing in training and accounting technologies is difficult, so our services will help these save costs and time.

Charity Accounting Services offers cloud-based accounting services, so we mostly operate remotely or at our premises. In the case where you require services to be carried out at your office, we can arrange that at a higher cost than our regular services.

Each organisation have different needs, so we plan our regular meetings and timescales in line with your individual needs. In these meetings, we review our services, their impact on your organisation and any improvements we can make to our strategy.

You can contact us at any time in our working hours.

Our notice period for cancellation is three months to ensure a smooth handover

You can contact us at any time in our working hours.

If you are unsatisfied with our services, you can cancel our partnership.

In the first two months, you can cancel without notice. We guarantee not only to make a full refund of your two-month fee, but we will also pay you an additional one-month fee as our goodwill. After two months, you can cancel our services with two months notice.